An Unbiased View of Life Insurance

Table of ContentsLife Insurance Things To Know Before You BuyNot known Incorrect Statements About Life Insurance Top Guidelines Of Life InsuranceSome Known Questions About Life Insurance.The Ultimate Guide To Life InsuranceThe Ultimate Guide To Life Insurance

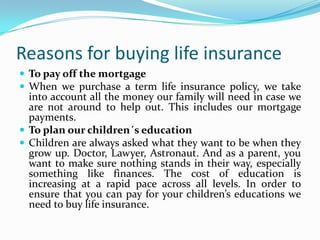

As we get older, obtain wed, develop households and also begin services, we pertain to realize a growing number of that life insurance policy is a fundamental component of having an audio financial strategy. Depending on your kind of plan, life insurance is rather affordable, which means there's no excuse not to get protection currently.Here are a few various other reasons living insurance policy is necessary - life insurance. If your enjoyed ones depend upon your economic support for their source of income, after that life insurance coverage is a must, since it replaces your earnings when you die. This is specifically vital for moms and dads of young kids or grownups who would certainly discover it difficult to sustain their requirement of living if they no more had accessibility to the income offer by their companion.

Even if you do not have any type of various other possessions to pass to your successors, you can develop an inheritance by purchasing a life insurance plan and also naming them as beneficiaries. This is a wonderful method to establish your children up for a solid economic future and also offer any type of financial needs that will certainly arise.

5 Easy Facts About Life Insurance Explained

Therefore, extra coverage is definitely important while your children are still at home. We can't understand when we'll pass away. Maybe today, tomorrow or 50 years from now, however it will occur ultimately. No quantity of money can ever before change a person. Extra than anything, life insurance coverage can aid give defense for the uncertainties in life.

It's one point you can be certain of and you'll no longer need to question whether they'll be taken care of when you're gone. Life insurance policy shields your successors from the unidentified as well as helps them via an otherwise tough time of loss.

The Single Strategy To Use For Life Insurance

A few of the most common factors for getting life insurance policy consist of: Surefire security, If you have a family members, a business, or others that rely on you, the life insurance advantage of a whole life policy serves as an economic security net. When you die, your recipients will certainly receive a lump-sum repayment that is guaranteed to be paid in full (offered all premiums are paid and also there are no exceptional finances).

Revenue replacement, Visualize what would take place to your household if the earnings you give unexpectedly disappeared. With entire life insurance policy, you can aid make certain that your liked ones have the cash they require to aid: Pay the home mortgage Afford childcare, health and wellness treatment, or other solutions Cover tuition or various other university costs Remove home debt Protect a household company 3.

Your representative can help you decide if any of these cyclists are ideal for you.

The 8-Minute Rule for Life Insurance

Life insurance policy is there to assist secure your household from monetary hardship. Here are a few other reasons to take into consideration. Life insurance policy can often be puzzling. Lots of people understand what it is, but they aren't actually sure why they might need a plan - life insurance. This can bring about people putting off obtaining a plan useful link or, worse, not obtaining one whatsoever.

Keep in mind, if you are a stay-at-home parent, the value you give through your work with your kids as well as at house is vital. If you were to die, your spouse would certainly have to spend for the services you offer taking care of your family. Life insurance policy is essential also if you do not have a spouse or kids.

The Facts About Life Insurance Uncovered

The same holds true for spending for expenses as well as other types of financial debt. If you pass away with credit history card debt or an auto loan, as an example, then that financial debt does not go away somebody will certainly need to spend for it. In most cases, that can be your partner or companion, and, if you are solitary, your moms and dads or siblings.

Your life insurance policy plan can additionally aid pay for your funeral solution and interment. This can aid minimize the worry your enjoyed ones might face trying to pay for it. When a liked one dies, it's constantly a psychological and difficult time. This already challenging period can be extra tough if there are concerns concerning replacing income and covering costs.

Recognizing they have your fatality benefit to cover the home loan, for example, can offer your partner the moment they need to move ahead at their own pace. There are a great deal of reasons individuals believe they do not need life insurance. Here are some of the most usual myths and Click This Link reasons and why they might not accumulate.

The Basic Principles Of Life Insurance

While that's an excellent beginning, in lots of cases, it will not be sufficient for your enjoyed ones to change your earnings over the long term. Plus, if you leave your task, that plan often visit the site won't travel with you.

Life insurance policy can occasionally really feel like a confusing subject. Resting with an economic professional or life insurance policy representative can be actually valuable. They can walk you with the policies that ideal fit your needs and also assist you figure out exactly how much protection you should have. Life insurance coverage shouldn't be something that you look at as component of your retirement.